Five Misconceptions about Trust in Business: Part 3

In this blog series, we explore five of the most common misconceptions about trust that, while they are widely-held, are powerful inhibitors to creating real trust:

- Trust has to be earned

- Trust takes time to grow and is quickly lost

- Clients just want you to solve their problem

- Clients will trust you if you give good advice

- Having the right answer is critical

MISCONCEPTION 3: CLIENTS JUST WANT YOU TO SOLVE THE PROBLEM

MISCONCEPTION 3: CLIENTS JUST WANT YOU TO SOLVE THE PROBLEM

Most providers think that clients are focused on solving the problem. No surprise there—most clients would say the same thing. Let’s dig a little deeper.

Of course, clients want providers to solve problems. That’s what they are paying for, after all. But if ALL you are giving the client is what they are paying for, you need to be incredibly better than anyone else to avoid constantly competing on price. And that’s incredibly hard to do.

Clients don’t seek to trust providers’ expertise …

… they seek experts they can trust.

Clients don’t want to be experts in the provider’s field. If they did, they’d have gotten their own degree or certification. They also know they will need that expertise again in the future. What they would really love to have, if only they could be so fortunate, is confidence in an expert on whom they could then rely repeatedly.

Most providers try to create trust by demonstrating, or at least talking about, their expertise. Clients therefore assume that their expertise is the most important thing they can offer. The implicit message is, “you can trust me to take care of this problem.”

Yes, clients hire you to solve the problem …

… but what they really want is for you to care about them.

If you focus solely on your expertise and successfully solve the problem, then your client will learn to trust your expertise, but what about everything else?

The alternative is to focus less on the problem, and more on the person. That’s not to say you should perform poorly, but that you should also show your client there’s more to you than you’re your expertise.

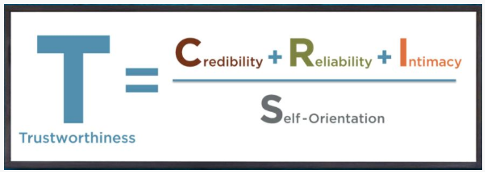

Real trust comes from understanding your client as a person – through curiosity, empathy, and your willingness to be vulnerable with them.

Real trust comes from caring enough about your client to share what you see can help them succeed.

Real trust comes not from solving this problem, but from helping them see the next opportunity or potential issue, whether or not you can help them with it.

Clients’ main vehicle for assessing trust is your ability to address the issues facing them, head-on, with all its emotional complexities. The beauty of that is, it’s what you already do for a living anyway.

Come back here to read about misconception 4: Clients will trust you if you give good advice.

Resources to Build Your Trust Skills:

- Join or watch a replay of our free webinars.

- Build trust on your terms through our Self-Paced Online Courses.

- Join the crowd and sign up for one of our Public Virtual Workshops.

- Subscribe to our newsletter.

- Follow us on LinkedIn.

- Contact us directly to learn about private workshops.

Let’s try a thought experiment. Imagine that you’ve been put in charge of an effort to improve the level of trust that people have in your organization (which could be a company, an institution, a business unit, whatever).

Let’s try a thought experiment. Imagine that you’ve been put in charge of an effort to improve the level of trust that people have in your organization (which could be a company, an institution, a business unit, whatever).

Fourteen years ago I wrote the following thoughts on New Years resolutions. It feels even more relevant this year, as we breathe a collective sigh of relief that 2020 is finally over.

Fourteen years ago I wrote the following thoughts on New Years resolutions. It feels even more relevant this year, as we breathe a collective sigh of relief that 2020 is finally over.

emotions, feelings, reactions, perceptions, elephants-in-the-room, the unspoken issues. All these can be raised in the context of the-personal-in-business: things that are happening in the workplace.

emotions, feelings, reactions, perceptions, elephants-in-the-room, the unspoken issues. All these can be raised in the context of the-personal-in-business: things that are happening in the workplace. It’s fair to say the vast majority of us have not experienced a global public health crisis at a scale similar to the one we are experiencing right now with COVID-19.

It’s fair to say the vast majority of us have not experienced a global public health crisis at a scale similar to the one we are experiencing right now with COVID-19. I’ve often wondered: is our real workplace office the coffee shop?

I’ve often wondered: is our real workplace office the coffee shop?

Twelve years have passed since I first wrote the following thoughts on New Years resolutions. Frankly, it was good. And frankly I haven’t been able to write a better one.

Twelve years have passed since I first wrote the following thoughts on New Years resolutions. Frankly, it was good. And frankly I haven’t been able to write a better one.