Summary

Procurement’s journey from transactional processing to strategic business partnering is not complete. Many argue it has even stalled. Some personal successes are evident, but they are individual achievements, not an organisational model that can be copied.

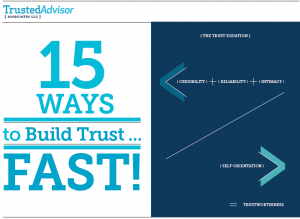

We argue that this should surprise no one. There are too many unresolved conflicts between the role of procurement and its internal clients, and that the savings metrics used by Procurement belong to a former age and aggravate the problem. Where good relationships exist, they do so between individuals who trust each other in spite of these conflicts. We argue that trust is fundamental and essential in the type of relationship that Procurement is aiming for, but that the metrics and governance used by Procurement are antithetical to its aims.

Procurement has pushed hard to attract brighter and better staff but research shows that capability is not enough. A genuine understanding of and concern for clients’ ambitions and goals is needed: Procurement needs to be benevolent as well as capable in the way it works with clients

Six distinct areas of conflict demonstrate how Procurement’s targets and metrics serve to defeat its strategic aims, and to undermine the work it invests in building capabilities. These include incentives to engage late with vendors, to over-specify requirements, and even to shrink a business rather than grow it.

We conclude that there is a need for an alternative to Savings as the main reporting metric for Procurement; the one we recommend is Spend Control Index. This isn’t a completely new concept, but very few organisations set out to use it rigorously as their primary indicator of Procurement’s performance. In the authors’ view, doing so would catalyse a change in behaviour and encourage real trust–leading to the strategic business partnerships all parties desire.

Tensions in the Realm of Procurement

Procurement today is a complex management service, intended to support the strategic aims of the organisation. However, some of Procurement’s intended customers are confused about its role and intentions–and hence don’t trust its motives. This is only partially due to customers’ misunderstandings; a good bit of it is Procurement’s own fault. Whilst presenting itself as a strategic business partner, some purchasing practices are in fact tactical–and worse yet, self-serving.

This creates a trust issue with Procurement’s clientele—both internally and externally. In a day and age where collaboration is a strategic must, unnecessary tensions created between an organisation’s own business and functional units are strategically relevant and financially harmful.

Kinnaird and Movius, arguing for a more sophisticated approach to negotiations observed that, “On the one hand, business leaders…want to be able to sit down and talk freely with their counterparts, shaping deals and exploring potential options. On the other hand, we have procurement attempting to constrain dialogue within a process that it insists on controlling, seemingly fearful of the very relationships that business leaders want to cultivate.”[i]

The reasons for lack of trust show up mainly in Procurement’s target metrics and the way in which Procurement reports them. The metrics are excessively focused on savings, even when those savings are secondary or cannot be measured. While savings are a proper target for certain cost-down programs, the aggregated total of savings is a misleading performance indicator: its acceptance and use create perverse incentives.

Deeper down, these tensions are an outcome of two distinct views of Procurement: one rooted in transactions, another based on relationships. Both views are necessary; but the inability to distinguish between the two as the situation demands creates dysfunction.

We suggest that a solution lies in better defining Procurement’s transactional vs. relationship responsibilities. We offer such a view, as well as a metric for control over external spend. This is a performance indicator superior to cost savings. Accepting this as an over-riding objective would align Procurement with its customers, create trust, and make it a truly strategic partner.

Context: the Changing Role of Procurement

Procurement has three broad functions.

- The first is managing internal transactionsfor ordering and receiving goods and services, and handling procurement data. The primary goal here is to maximise the efficiency of transaction-flow and reporting.

- The second is support for vendor engagement and contracting processes. Procurement’s roots are in regular price negotiations for raw materials, packaging, tools, consumables, components and other regular purchases. It is largely a tactical and transaction-focussed process.

- The third area is “value-based strategic procurement that can translate into bottom line improvements to the corporation …to ensure that the Procurement strategy is aligned with, and that it rolls-up to, the overall corporate strategy.”[ii]

The Internet has created massive opportunities for driving efficiency in the first two functions—from automating order processes to establishing online, blinded bid systems, for example. These have the lion’s share of attention in the general management press. However, apart from that, the essence of the first two roles has not substantively changed.

It is in the third role that procurement has attempted a metamorphosis[iii], in several ways:

- Procurement is increasingly responsible for buying non-traditional services such as consultancy, audit, training, and legal.

- Procurement now challenges specifications developed by its own internal customers–and in some cases, even the basic need for a purchase.

- It may draft or even own the organisation’s strategy for buying goods and services with high transaction volumes, such as travel, office supplies and MRO (maintenance, repair and operation). In some cases

- It may support or lead outsourcing projects.

“This change, with half of [Procurement departments] looking after marketing spend and more than two-thirds in charge of professional services, suggests an increase not only in their responsibility, but also in influence at a strategic level. It also suggests a shift towards an increasing responsibility for people-related buying”[iv]

General Managers and the public still tend to think of Procurement as being essentially about bargaining. But it now aims to create value and even competitive advantage on behalf of its internal customers in all activities relating to vendors, according to this received wisdom. But has its outlook matured sufficiently to match these responsibilities? And how do its customers see it?

Schiele & McCue[v] describe two main traits that determine the level of meaningful involvement that a purchasing department can have with client departments. They are:

- Ability: the extent to which the purchasing department has the requisite expertise and ability to benefit the client department

- Benevolence: the extent to which the purchasing department is concerned about the needs and interests of the client department

Chief Procurement Officers (CPOs) have invested heavily in staff and training in order to build expertise and achieve the first trait. But both traits must be present if client departments are to have trust in the purchasing department; and there is evidence that benevolence has not been addressed with the same rigour as ability. [Italics show terms used in the original paper by Schiele & McCue].

The problems of tactics, conflict and trust arise when Procurement’s traditional, tactical roles are confused with the strategic position it wants to be in. This typically happens in the realm of performance measurement.

Six Areas of Conflict

There are six areas in which confusion between the traditional tactical role and the new strategic role arises, and which in turn lead to conflict.

1. Price vs. Value Assessments

Procurement often helps internal customers (budget owners) to understand a need better, identify the best goods and services for that need, and undertake cost/benefit analyses for different solutions. When there are more factors to consider than price alone, Procurement uses weighted criteria to evaluate the best offer. Customers often appreciate this help.

However Procurement’s target, as well as the annual assessments of its managers, is based mainly on achieved savings, so they have an incentive to push hardest on price rather than other factors that contribute to value. The effect is that intentions are unclear, incentives are mixed, and customers are confused, even resentful.

2. Market-based Solutions

There is an instinct in Procurement to challenge price through competitive tendering. This is based on a faith in the rational outcomes of markets dealing with common (commoditized) goods. The aim of procurement then is often to formalise the requirements, remove subjectivity, and bring the service as close to a commodity as possible[vi] [vii]. It’s a great theory and hard to argue against – if it did not conflict with the way people actually make purchase decisions.

In practice, we as humans indeed use rational criteria in the screening part of a down-selection process, in order to create a short-list of suppliers, all of whom are qualified to provide the required goods or services. But then we tend to look the supplier candidates in the eye to decide which one we would like to deal with; this final selection stage is less cognitively-defined and less tangible. Senior managers are paid to make judgements, and they do so.

Procurement’s aim is typically to commoditise all goods and services so as to remove intangibles like trust from the vendor-selection process. This works well in the first phase of screening, where those are unarguable virtues. In this phase, we want an empirical, fact-based process in which the vendor is selected by weighted criteria, set against price.

But when it comes to the selection phase, client managers want to explore a relationship with the final candidates and test their own comfort level before moving forward. This is a decision model that’s entirely different from the rational, screening process. There’s nothing wrong with this conflict, but it is one that many Procurement staff fail to deal with because of their focus on the traditional, tactical transaction processes.

3. Explicit vs. Implicit Contracts[viii]

Explicit contracts are written and formal. Implicit contracts are not: they are usually created during a working relationship and are based on trust. Often the two go together: the explicit contract is agreed between the organisations at the start; and implicit deals, based on trust, develop between individuals working together.

Procurement, reflecting its transactional responsibilities, worries about cosy relationships that circumvent the formal buying process; but it may fail to recognise that implicit deals are essential – and try to over-formalise.

It may even go further, towards the deliberate exploitation of a vendor’s trust and the breaking of implicit deals. For instance, a vendor may invest in production capacity and stock to provide reliability that justifies a price premium, only to find that the business is tendered to the lowest bidder. Such a case represents a tragic triumph of the tactical—taking pride in counting transactional battles won – at the expense of a war lost on relationships.

4. Strategic Discussions

Chief Procurement Officers say their staff should become involved in projects earlier and more strategically, in order that they can drive efficiencies and cost avoidance during the planning and design stages of projects, not just during final vendor negotiations. They recruit and develop purchasing managers with higher-level skills, who can work strategically with their clients’ functional leadership teams.

But these strategic discussions raise a tension when it comes to measuring performance, a tension that is frequently ignored. Procurement performance is typically measured by cost savings. This is what many clients assume as obvious Truth, and many CPOs don’t offer an alternative. Unfortunately, pursuing strategic objectives can lower the possible range of savings targets. Here’s how.

At first, everyone agrees on the value of early, strategic engagement. It creates clarity of the business issue, sharper specifications, more appropriate technical solutions, and earlier screening-out of unsuitable suppliers. But this narrows the delta which Procurement is able to report as a saving. With a smaller number of qualified suppliers, the gap between the highest and lowest bidder is reduced and it is even possible that the highest bidder offers the best overall value. How, if they are rewarded mainly on savings, is the Procurement Manager incentivised to invest time and effort in strategy?

Until 2009, Procurement departments accepted (or conspired to ignore?) this paradox. However, as the financial crisis hit, many CPOs told their staff to focus on tactical savings and to forget the strategy. The switch in approach confused many clients and reinforced perceptions that Procurement was, after all, a tactical service.

5. Contrived Calculations

Continued use of transaction-based metrics to evaluate strategic objectives can lead to serious gaming of the system. For example, procurement savings on raw materials can be translated into P&L accounts only if there are on-going purchases and like-for-like unit-price comparisons. Often, however, this is not the case, so Procurement looks for reportable savings in:

-

- The difference between two quotes

- External benchmarks

- Internal changes (e.g. job cuts)

- Other benefits (e.g. production efficiencies, waste reduction, reduced working capital)

These calculations have a subjective element but they are nevertheless aggregated with unit-price reductions, to create the headline number reported by the CPO.

Reported savings also address only the areas that Procurement chooses to report. A price rise (a negative saving?) is likely to go unreported. And there is an incentive for Procurement managers to harvest savings the way farmers harvest hay, allowing the crop to grow longer in order to get a better yield. Procurement managers may see larger reportable savings from areas that previously they have creatively neglected!

One Head of Group Procurement reported hopefully to a seminar[ix], “The single reason for us being credible, for us gaining strategic and professional status within the business is nailing the notion of whether something is a genuine cost saving or a made-up number”. In order to achieve this, Procurement departments may report savings under three headings: hard savings based on unit price reductions; cost avoidance, e.g. from demand reduction; and value-add, from additional business benefits without increased spend. In the opinion of the authors, these acknowledge the weakness of savings reporting without offering a more useful alternative.

Realistically, most executives know that a CPO’s reported aggregate savings number is not real. But they accept that cost reductions are generally desirable and should be encouraged. So they offer praise to the CPO, and pretend that the reported savings are meaningful. After all, they may think to themselves, there is little to be gained by scepticism.

This back-and-forth game is played with both parties insisting that they believe in rational, quantitative, measurable results, but with each vaguely knowing that the numbers are fudged. This lends a hypocritical, even cynical, flavour to the relationship between Procurement and management–to the detriment of both.

6. Operating Budgets vs. Strategic Spending

Some organisations translate savings into budget cuts, especially those where Procurement reports through Finance.

Not surprisingly, managers may be disinclined to accept support from Procurement if their operating budget is reduced as a consequence. Whilst these budget-owning managers did not previously voice their doubts openly about the unreliability of Procurement’s reported savings, it may be a different matter when their own budget is threatened in order to deliver Procurement’s bonuses. To a client, it seems that Procurement’s aim is to always to shrink the business.

All six of these areas of conflict have one thing in common. They arise because there is a single metric on which Procurement expects to be measured and which it emphasises above everything else when presenting its performance and promoting its value to the organisation: the aggregate total cost reductions across all of its activities, savings.

But savings have no value to other business units (though we duly note the value to financial stakeholders). Regarding the management of the organisation, the only practical use to which the reported savings total can be put is the reward of procurement staff. It does not help or guide decision-making in any other function; it does not inform the ‘what’ or the ‘how’ of management team decisions. It stands alone, detached from everything else in the organisation; related only to the previously reported savings total.

When the CPO reports the aggregated savings total, she or he compares it only to two things:

- The previously reported total

- The volume of extra sales that would be required to deliver the same value to the bottom line.

Neither is likely to engage the management team positively, still less win their hearts and minds.

The Procurement Dilemma

The net of these six areas of conflict is that Procurement faces a dilemma. By history and tradition, it focuses on managing transactions and increasing internal efficiencies of internal processes. The relevant measure for such a role is a focus on hard savings.

At the same time, Procurement’s increasingly successful self-elevation into strategic partnerships endangers its reliable sources of hard savings. And since no one—including CPOs—has effectively argued for a new and discrete metric, unresolved arguments and confusion abound. The role has changed, but the measurement has stayed the same–and no one has stated the problem clearly enough to permit resolution.

CPOs may deny this, but evidence is clear. When interviewing Procurement managers about where they invest their time, they say they have to focus on reporting short-term savings. Running a tender or auction is a quick and efficient use of their time: it delivers easily reportable savings and meets their targets.

On the other hand, identifying better business processes and becoming involved in change management are time-consuming and high risk. In a cost-reduction climate, ‘You don’t need a weatherman / To know which way the wind blows’[x] so strategy loses out. This is the message that Procurement teams are getting: ‘Strategy is a nice-to-have, but when the chips are down, we are measured on savings.’

A Better Way

The solution is two-sided. One part is a better understanding of the emerging role of Procurement, and the dual function it must perform. The other part is the metrics, a particularly powerful tool in Procurement.

Because the very nature of performance assessment for Procurement is so quantitative, it may be useful to put the “cart before the horse” and focus on a revised metric as the most powerful lever for change.

It would be naive to stop reporting aggregate savings if there were nothing to put in its place. But there is a move towards a different key performance indicator – one that has more credibility, can be supported by Internal Audit, and that aligns Procurement with the interests of its internal clients. It allows procurement organizations to build the trust they need in order to become a strategic partner.

That indicator is Spend Control Index (SCI). It is not completely new and some organisations have something close, called Spend under Management, with the nice acronym, SUM. Instead of focusing on a spend area only when a purchase is imminent – and restricting reporting to those areas they have actively worked in – the aim is to make Procurement accountable for all spend. Not just for the spend that can be easily seen and measured, but for a top-down calculation of external spend, derived from turnover, adjusted for salaries, earnings, interest, extraordinary activities, depreciation and working capital.

Using this base (100% of spend), Procurement identifies the proportion where spend is actively and fully managed by Procurement according to a strategy agreed with the business. This article does not define the calculation of Spend Control Index as it may vary from one organisation to another; but we can identify factors that could be used as the basis of an audit. After assessing the monitoring and control systems, an auditor would examine items of spend from different functional areas and supply channels. By checking the level of control and compliance in each, they can sign-off on the Spend Control Index claimed by the Procurement department. Key indicators of control for each item of spend include:

-

- Is there an identified Procurement manager with accountability for ensuring that the item is efficiently and effectively sourced and that purchase transactions follow the correct channels? Is this person recognised by the business as the point of escalation for purchasing issues?

- Is the item covered by a Procurement strategy that is documented, less than twelve months old, and formally agreed with the budget owner?

- Is there an internal communications document to inform users how to acquire the goods or services? Are users instructed on how to find this document, how to deal with the vendor and how to escalate issues?

- Is there an identified manager who is accountable for ensuring that the item is delivered and used according to the agreement and in line with business requirements? This person may be called a contract manager, vendor manager or service manager and they are usually line-managed by the budget owner, rather than being in the Procurement department.

- Are the correct procurement channels and transactions being used?

Reporting the proportion of total spend that is under control gets real attention from the executive team and relegates tactical savings to second place. Maximising the Spend Control Index is more easily aligned with business objectives; and Internal Audit can check its measurement. It is not even necessary for Procurement to manage everything hands-on. In the same way that Corporate Counsel is accountable for an organisation’s legal compliance, but does not have to be present in every business meeting, Procurement’s role no longer needs to be so interfering.

Increasing Trust in the Procurement Function

If an organisation wants Procurement to manage its cost base strategically it must help it to escape from the rut of transactional models, and from the exclusive use of tactical savings as its main performance indicator. Savings are a good metric for individual projects but, as an aggregate overall measure of performance, they are misleading and lead to perverse behaviours.

A function trapped by such a metric is unlikely to become a trustworthy partner to the rest of the organisation. A trustworthy partner should be evaluated in terms of the benefits it can bring through being trusted more broadly. The alignment of goals and metrics, through adoption of a Spend Control Index, will itself contribute to greater trust of Procurement staff, as well as in the system.

Endnotes

[i] T Kinnaird and H Movius “Avoiding the Three Deadly Sins” CPO Agenda Autumn 2008”

[ii] J Mahoney & G Stoller, “Strategic vs. Tactical Procurement – Shifting Focus Towards Value Creation” July 2009 http://www.slideshare.net/jamie.mahoney/tactical-vs-strategic-procurement-shifting-focus-towards-value-creation

[iii] A Moorhouse, “Insight into the changing role of the procurement professional” (Bradford University School of Management) 2006

[iv] S Bagshaw (Editor), “Direct vs. Indirect Procurement – Market Intelligence Survey”. (Supply Management & buying Team) September 2009

[v] JJ Schiele and CP McCue, ‘Professional service acquisition in public sector procurement: A conceptual model of meaningful involvement.’ International Journal of Operation and Production, Vol 26, 3 pp 300-325. 2006

[viii] J Kay, “Foundations of Corporate Success” (Oxford) Chapter 4, Relationships & Contracts

[ix] S Santarelli “Cost Savings in the Spotlight“ (Procurement Intelligence Unit) 24 September 2009 www.procurement-iu.com/ Internet publication

[x] B Dylan “Subterranean Homesick Blues” Columbia Records [catalogue 43242] 1965

I’m reading a lot lately. Some of it’s more out-there, some of it’s rock-solid business. Two books that fall into the latter category are Jack Malcolm’s

I’m reading a lot lately. Some of it’s more out-there, some of it’s rock-solid business. Two books that fall into the latter category are Jack Malcolm’s  Zero-Time Selling

Zero-Time Selling

In case you missed it, here’s your opportunity to get a copy of our latest eBook, “

In case you missed it, here’s your opportunity to get a copy of our latest eBook, “ We’re about halfway through our countdown of Trust Tips leading up to the release of “The Trusted Advisor Fieldbook: A Comprehensive Toolkit for Leading with Trust,”

We’re about halfway through our countdown of Trust Tips leading up to the release of “The Trusted Advisor Fieldbook: A Comprehensive Toolkit for Leading with Trust,”  I was still afraid of the Sales Monster Under the Bed when I was 32.

I was still afraid of the Sales Monster Under the Bed when I was 32.