The Traveling Salesman? Or the Prisoner’s Dilemma?

The Prisoner’s Dilemma is a classic conundrum in game theory. It purports to explain why two people might not cooperate, even if it is in both their best interests to do so.

It turns out that the solution to The Prisoner’s Dilemma is also the solution to a great many sales problems—those in which your customer doesn’t trust you. Are you living in the Dilemma? Or are you living in the solution?

The Dilemma of the Prisoner

Here is a classic version of The Prisoner’s Dilemma:

Two suspects are arrested by the police. The police have insufficient evidence for a conviction and, having separated the prisoners, visit each of them to offer the same deal:

- If one testifies for the prosecution against the other (defects) and the other remains silent (cooperates), the defector goes free and the silent accomplice receives the full 10-year sentence.

- If both remain silent, both prisoners are sentenced to only six months in jail for a minor charge.

- If each betrays the other, each receives a five-year sentence.

Each prisoner must choose to betray the other or to remain silent. Each one is assured that the other would not know about the betrayal before the end of the investigation. How should the prisoners act?

What’s a poor prisoner to do?

If you analyze the situation rationally (the way a game theorist or economist defines that term), your odds are a lot worse if you remain silent – either you get 10 years or six months. But if you rat on your partner, you either get out free or, at worst, five years.

So, reasons the economist, Option A’s average “value” is five years and three months in prison. Option B’s average is two and a half years. “Ah ha,” says the economist’s rational player, “I’ll go for Option B.”

Of course, the other player does the same math and comes to the same conclusion. As a result, each gets five years in prison—a total of 10 prison-years between them.

The dilemma is that – if only the prisoners had cooperated with each other, they could have each gotten out with just six months in prison – a total of one prison-year between them.

The question is: why don’t they cooperate?

At least, that’s the economists’ question. In the real world, cooperation is quite common.

So the real question is: why do so many people listen to economists?

The Dilemma of the Salesperson

Before answering the Prisoner’s Dilemma, let’s note the similarity with The Salesperson’s Dilemma.

The salesperson has a similar series of trade-offs. For example:

- “I could take some extra time to study up on tomorrow’s sales call, getting to know more about the prospect. That would improve the odds of my getting a sale tomorrow.”

- “On the other hand, I could make another cold call with the time saved if I don’t spend it studying up for tomorrow’s call.”

Or, another example:

- “I could tell them we have very little experience in this area, which would increase their sense of my honesty, which would help me in the long run.”

- “On the other hand, experience might be the key in getting this job, so perhaps I should make the best case I can and fudge the rest.”

Still another:

- “I could share a lot of my knowledge with them, which would really impress them and make them grateful to me.”

- “On the other hand, if I give it all away in the sales call, they might just steal my knowledge and not pay me for it – perhaps I should wait until after we have a signed contract.”

And one more:

- “I could go out on a limb and make some really far-sighted observations that would help them—it would go way beyond what they asked for.”

- “On the other hand, we don’t have much trust built up yet. They might see that as presumptuous or unprofessional; I’ll just answer the questions they asked.”

Just as with The Prisoner’s Dilemma, if the salespersons continually choose Option B, they will sub-optimize. They will do cold calls, leading with no relationship, taking no risks, treating the customer like a competitive enemy, and offering no great help.

In other words, they’ll lose. Just like the prisoners.

In theory, the prisoners are identical, whereas the salesperson and the customer are distinct. But that’s theory. In the real world, sellers somehow tend to find buyers who are similar to them. Sellers who are fear-driven and guarded somehow often find buyers who justify their worst fears. (Or, what amounts to the same, sellers project fear, and buyers reciprocally return the same – as humans are wont to do).

Both seller and buyer often operate from the Prisoner’s script. And the result is just as sub-optimal.

The Prisoner’s Solution

As postulated by economists and game theorists, The Prisoner’s Dilemma is usually presented with two key assumptions:

- The game is played only once

- The players do not know each other

The solution lies in changing each of those assumptions. If you tell the players the game will be played 10 times, cooperative patterns begin to emerge. If it’s played 100 times, cooperative strategies take over.

If the players are given information about each other, they become less abstract to each other. If the information is personal, then the relationship changes tone as well.

These two dimensions – time and relationship – are critical. Without a sense of continuity over time, and without a sense of personal relationship, those playing the game will opt to “rat out” each other – even knowing that the result, system-wide, is negative for them on average. But given time and relationships—the optimal solution emerges. Everyone is better off.

In other words, the solution to behaving stupidly is to develop personal relationships over time. Now let’s see how that insight applies to selling.

The Sales Solution

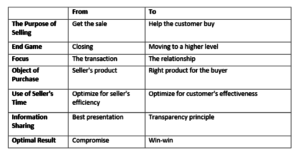

The sales solution should look pretty obvious now. Suboptimal behavior is the result of short timeframes and shallow relationships. In a Prisoner’s Dilemma world, both buyer and seller fear each other, suspect the worst, don’t have relationships beyond the transaction, and are interested primarily in their own self-aggrandizement, without regard to cost to the other party.

If that sounds familiar, just look at what sales topics are hot these days: sales automation, lead screening, CRM, social media lead generation, predictive analytics, search-based prospecting, multi-channel messaging. Think about the last step in nearly every sales process model you’ve seen—closing.

What all these subjects have in common is a view of selling that is a) transactional and b) impersonal. In other words, they have short timeframes and weak relationships—two things sure to hurt sales.

Selling benefits from longer timeframes and better personal relationships. If you can stop thinking like an economist and work to eliminate the fear you and your buyers have, you’ll benefit from the long-lasting trustworthy relationships that develop as a result.

A lot of casual bloggers out there – and a few not-so-casual writers, even some famous people – are fond of quipping about trust in ways that at first blush sound wise.

A lot of casual bloggers out there – and a few not-so-casual writers, even some famous people – are fond of quipping about trust in ways that at first blush sound wise.  Nowhere am I so desperately needed as among a shipload of illogical humans.

Nowhere am I so desperately needed as among a shipload of illogical humans.